If something is extremely expensive, there’s a saying that it costs an arm and a leg. If you consider today’s US housing market, however, then younger generations would have to cough up more limbs than they themselves have. Very fitting seeing as how a lot of younger gen people can only dream of having their own house at this point.

The topic of housing in the US has been a hot one over the past several years as the housing market has reached and, in fact, gone beyond the point of being sensible with its pricing. And if you’re not convinced it’s a sad reality, consider this Reddit post.

More Info: Reddit

They say there are only a few constants in life: change, death, taxes, and, of course, the ever-inflating prices in the US housing market

Image credits: Frans van Heerden (not the actual photo)

A Redditor shared his frustrations with the current status of housing in the US, sparking a number of discussions on the platform

Image credits: Benjamin5431

In the post, the Redditor explained how more than half of his paychecks is spent on rent, whereas his older coworkers only pay half that in mortgages

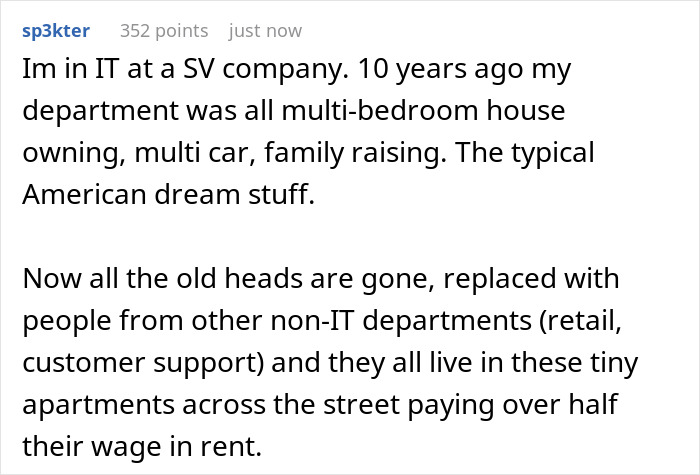

Redditor u/Benjamin5431 was having a conversation with an older coworker when he asked why OP works two jobs. OP’s response was that his rent is $1,800. The coworker experienced light shock after being told that no, Benjamin does not live in a mansion, but actually in an 800 square foot (around 74 square meters) apartment.

In (stark) contrast, the coworker explains that his mortgage is half that for a 4-bedroom house he got a few decades ago for $100,000. A quick Zillow search deduced that the house is now worth 4 times as much.

Now, OP has been doing the same job his coworker used to do, the same exact positions. But the coworkers all managed to buy their houses in their 20s, while the younger generations will practically never be able to even afford starter homes if things keep getting worse.

Not only that, but a quick Zillow search deduced that the coworker’s $100K 4-bedroom house is now worth $400K

Image credits: Max Rahubovskiy (not the actual photo)

Bored Panda got in touch with Benjamin, who explained that he wrote the post to show the extreme contrast between the costs of living for younger and older generations.

“Even if you bought a house only 5–6 years ago, you’d be in a completely different universe than those trying to buy a house (or rent) under 2023’s market rate. I say this because I did purchase a house 6 years ago. It was expensive and cut-throat enough even back then, but it’s far worse now,” elaborates OP.

“I have siblings, parents, other relatives and co-workers who have bought houses many years ago, some of them decades ago, and their mortgages on huge, nice houses are very affordable, AND they have higher incomes as well. It just shows how much more difficult it is for today’s generation to own real estate and build wealth, and really just to survive without being homeless.”

To put all of this in context, OP shared with us that, across the two jobs, he makes around $3,500 per month before taxes. Rent is a bit over half of that gross sum. Besides this, there’s also food, gas and other commodities to deal with, the prices of all of which are skyrocketing. To top it all off, OP also has a newborn kid, which not only means the cost of parenting, but also owing the hospital thousands of dollars on top of paying $600 health insurance fees every month. OP added that most folk in the area (and age range) make around the same amount of money, i.e. $40,000 to $60,000 per year ($3,300 to $5,000 a month).

All of this points to an ever-increasing issue of affordability, with statistics showing little change in wages, but a doubling (if not more) of house prices in the last 30 years

Image credits: Tima Miroshnichenko (not the actual photo)

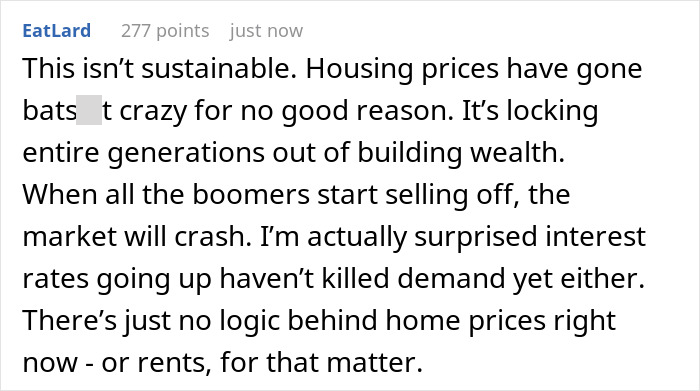

So, what has driven up those prices? The overarching problem is too much demand, not enough supply. But the issue gets worse because [1] millennials, having been delayed for years in becoming homeowners, are just now entering the market, thus having to compete more with later gens; [2] homeowners from previous generations opt to spend their late years at home as opposed to retirement venues, and [3] the number of properties owned by investors has doubled to 20% since 2010. And if resources are scarce, the price goes up. Fast.

To put it into more context, it is reported that in the 1990s, the price of a single-family home was roughly 3 times more than the median household income nationwide. In fact, in many metropolitan areas, the home-to-income ratio was below 2.6, which is considered a threshold of affordability. 2022, unfortunately, is a record-high year, clocking in at 5.3 times more than the median household income—double what is considered affordable.

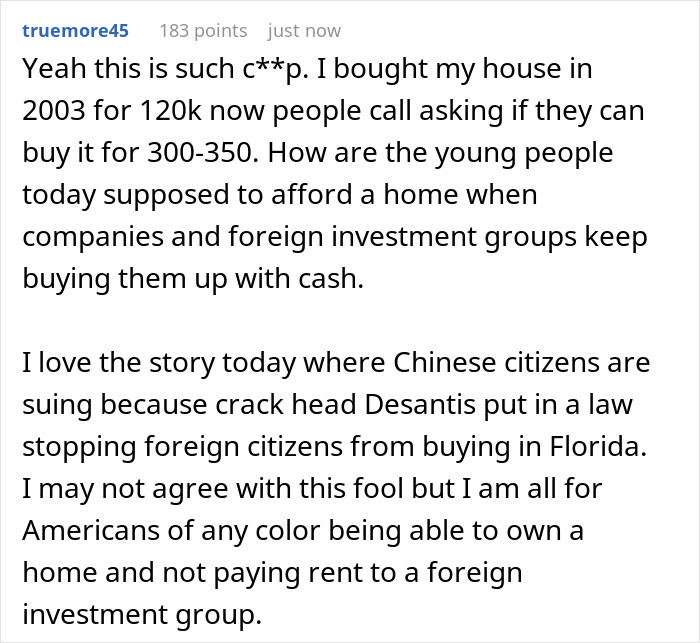

Besides the elephant in the room, all of this is also giving rise to another problem, which is that older generations—mostly homeowners—are getting seriously out of touch with reality when it comes to housing. And this in turn leads to all the “millennials could afford houses if they just stopped buying Starbucks” comments. Not dealing in absolutes here, but there is a reason behind the whole “ok boomer” thing.

“A lot of older generations are out of touch because many of them simply aren’t looking for houses to buy or places to rent right now, so they don’t know,” added OP. “They also rely on THEIR experience with buying property and renting, and since times are so much different, their knowledge isn’t applicable.”

“Times have changed. Prices have soared, incomes have not, benefits have gotten worse. I was talking to my father yesterday: in 1989 he was making $40-$50k as a body shop employee at a small, locally run bodyshop in Georgia. This same exact body shop is still in business, and the employees there still only make $40k-$50k. However, houses in the area went from being $50k-$150k back then to being $350k-$600k+ now.”

The main culprit here is too much demand, not enough supply, with a little nuance here and there

Image credits: Sora Shimazaki (not the actual photo)

So, what can be done? A lot, actually. And all of it. Actually. Many in the comments did point to large corporations and other investors buying up properties and developing them to be rented or sold. At least, this is the fast and most effective way of mitigating the crisis. But there’s more to it.

“The solution has to be multifaceted because the issues causing housing unaffordability are multifaceted,” elaborated OP. “1st, the state or the federal government needs to incentivize investors to build more houses. There are many places being built in my area, but literally every single one of them is ‘luxury apartments/townhomes’. Slapping luxury on the name (when they really aren’t luxury at all) allows them to charge sky-high rent and justify it. Even though there is a lot of building here, it’s all unaffordable options, so this doesn’t help affordability. It would be like if people who lived in a ‘food desert’ couldn’t afford food but a bunch of upscale grocery stores opened up that only sell filet mignons and wild-caught salmon. That wouldn’t really help people.”

“The other issue is investors have found out it’s cheaper and more profitable to just buy up homes, then sell them at a later date when values rise and make money. This doesn’t add inventory to the market, it takes it away, then since the object of the game is to sell more than what you paid, it just causes the price to always go up. So, something on the state or federal level needs to be done to stop housing speculation. It adds nothing to the economy, it only makes things more expensive.”

“And lastly, price controls. Usually supply and demand determines a fair price, if it’s too high people won’t buy it. Housing breaks this rule. The demand is always high. People will pay as high a price as possible because the alternative is being homeless. There needs to be a limit on how much a company can raise rent in a period of time.”

Many suggest that if big investors didn’t invade the market and the government had more control over how it’s done, housing would be much more affordable

Image credits: Ben Yokitis (not the actual photo)

Benjamin explained that rent on his last apartment went from $1,450 to $1,850 within the two years. This meant a change in careers to be able to afford the increase, which translated into gaining no extra money, as it all went into rent. And it would be a blessing if it was just rent.

“This system is predatory, it siphons money away from workers into the hands of already rich property owners and investors,” added OP. “More needs to be done to give workers and renters more bargaining power and more control over the housing market. Right now apartments and houses for rent are doing whatever they want; charging ridiculous fees, non-refundable application fees and admin fees, raising rent by hundreds, tacking on a bunch of random fees to your rent which should be included in the price in the first place, requiring extremely strict income and credit requirements, huge deposits, etc. And we have no power against them to retaliate.”

OP’s post sparked quite a discussion on the topic. So much, in fact, that the post has around 4,300 comments. This is besides the 61,500 upvotes and a handful of Reddit awards.

Besides witty comments about the American Dream (or the myth thereof), folks shared their own predicaments and stories in the comments, further painting a real picture of just how ridiculous housing prices have become over the years. You can check it all out in context here.

But before you go, we’d love to hear your thoughts on everything from inter-generational struggles to the housing market in the comment section below!

Commenters had a lot to say on the now-viral Reddit post with over 61K upvotes

The post “The American Dream Is Dead”: People Online Discuss Insane Housing Prices After This Person Vents Their Frustrations first appeared on Bored Panda.